Professional-grade options, stocks, indices, and interest rates data. Millisecond latency. Unfiltered trade and quote data. Comprehensive Greeks. API-driven architecture for maximum reliability.

Our Data Products

Access comprehensive market data through our terminal

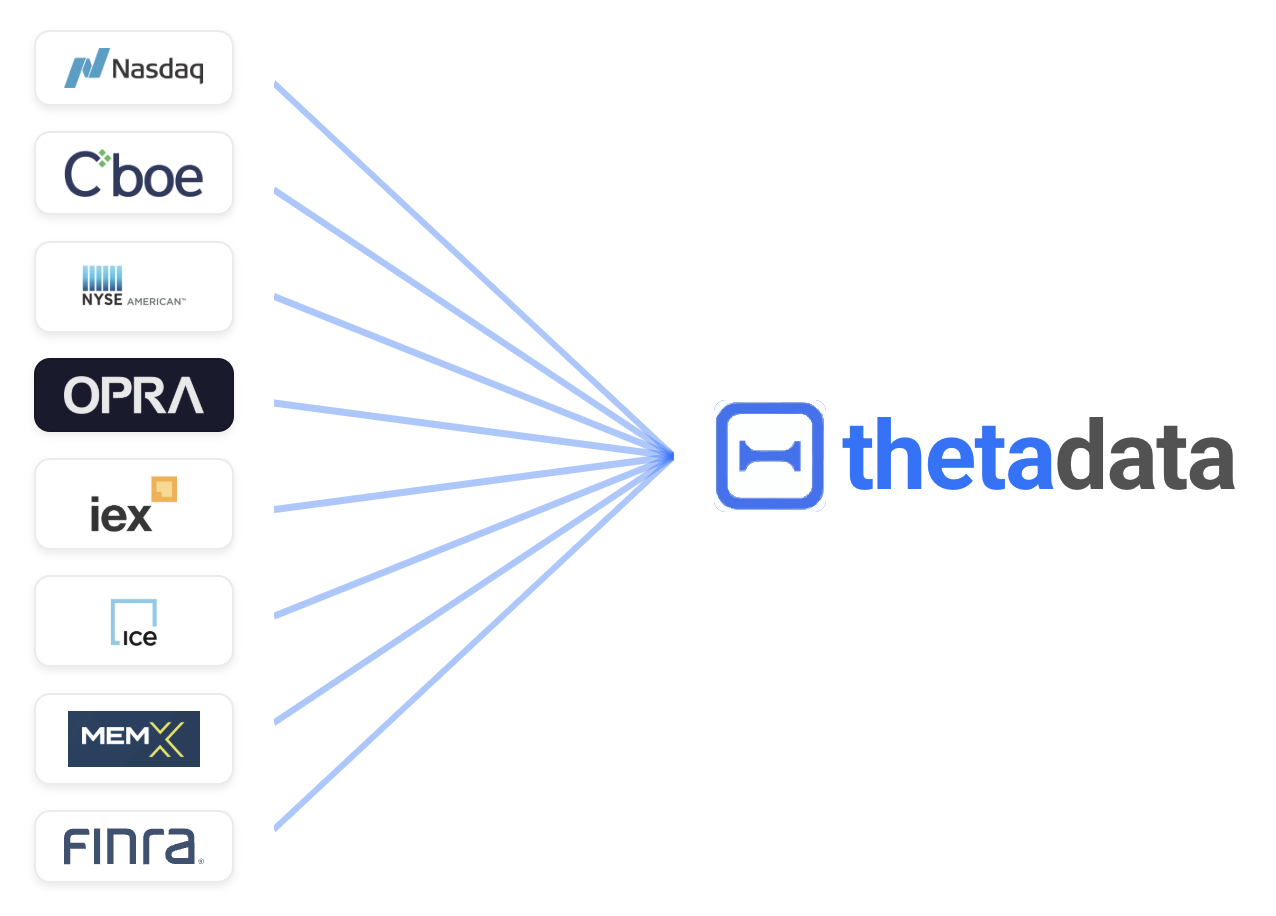

All US exchanges, low latency, and developer-friendly APIs.

Every trade. Every quote. Unfiltered.

Complete tick data from all US stock exchanges. No sampling, no filtering.

Real-time streaming with OHLC data, corporate actions, and historical access.

All Exchanges. Complex Greeks. Low latency.

Comprehensive options data with 1st, 2nd, and 3rd order Greeks. Trade and quote data with implied volatility calculations. Real-time streaming and historical access.

Every tick. Every move. Real-time.

Real-time tick data for major indices including SPX, VIX, RUT and over 1000 other indices.

Price and OHLC data with live streaming capabilities and historical access.

SOFR & Treasuries. 30+ years of history.

Comprehensive interest rates data including SOFR and Federal Treasury rates. Historical data for financial modeling, risk management, and derivatives pricing.

Why ThetaData

API-driven architecture eliminates browser bottlenecks. Direct WebSocket connections for real-time data delivery.

Every trade, every quote from all US exchanges. No sampling, no filtering, no data loss. Complete market coverage.

1st, 2nd, and 3rd order Greeks for all options. Implied volatility, trade Greeks, and bulk operations for efficiency.

Python and JavaScript SDKs. REST and WebSocket APIs. QuantConnect integration. Comprehensive documentation.

Local intermediary between you and our cloud. Removes browser security issues and provides consistent API endpoints.

Bulk historical data downloads for backtesting. Options and stocks end-of-day data in convenient formats.

Start with our free tier and upgrade as you grow. No credit card required.